CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

As you may know, almost every type of commodity is essential for modern society. From oil and natural gas to grains and precious metals, we can find dozens of usages in our daily activities and the goods we produce. Having such an important role has disadvantages because almost every event in the global markets affects its price. We are going to discuss how different factors, such as economic, political, and natural disasters, affect global markets and their relation to commodities.

For this purpose, we will measure it using correlation. The correlation coefficient measures the linear relation between two variables. It goes from -1 to 1. The lower bound means the two variables have an inverse correlation. When one goes up, the other goes down and vice versa. The upper bound means the two variables have a direct correlation. When one goes up, the other goes up too. The inverse is true. If the coefficient is 0, then there is no correlation between them.

Volatility

Overall, commodities have higher volatility than other financial assets. Mainly Supply and demand affect them. A recent example is the discovery of the biggest gold reserve in history. They claim that the gold found is equivalent to more than double the gold found in the history of humankind. This gold supply shock will pressure its price to decrease while we expect demand to remain the same.

Let’s recap on the start of the COVID-19 pandemic. Almost everyone had to stay at home for a long time. This shocked economic activity, making demand for commodities and primary materials fall sharp, but commodity production could not decrease at that pace, affecting companies that face logistics and storage issues. Oil futures prices went virtually negative because producers did not know what to do with the surplus.

Commodities correlation between interest rates

Central banks have managed interest rates around the world since their creation. They often use it as a tool to try to control inflation. A high-interest rate means the cost of capital increases and vice versa. Regarding commodities, the relation is inverse, meaning that if interest rates go up, then the cost of holding inventory also goes up and companies demand less, making the price of commodities decrease.

Commodities correlation between inflation

Many products that we use in our lives daily depend on commodities. So, any price movement in commodities may affect prices for the consumer. We can then infer that the relationship is direct. When commodities costs increase, inflation should increase too, resulting in an increase in product prices for the consumer. Investors have been using commodities as a hedge against inflation for a long time. However, the correlation has been losing strength since globalization took a powerful place in the world.

Commodities correlation to the stock market

We can access the stock market by buying stock or having a share in a mutual fund. Either way, all of these assets tend to have a positive correlation with each other. On the other hand, commodities have a low negative correlation between stocks and bonds. Although commodities suffer from higher risk when added to a diverse portfolio of stocks and bonds, it results in a lower overall risk.

Commodities correlation to currencies

Many countries’ economies have a strong relation to one or more commodities. This leads to a high positive correlation between that specific commodity price and the country’s currency. For example, an increase in oil prices can affect currencies in different ways. For countries like Japan, which imports most of its oil, the effect will be negative, increasing the costs of accessing that commodity using their currency. On the contrary, countries like Canada with huge oil exports will see their currency strengthen.

Commodities correlation to global recessions

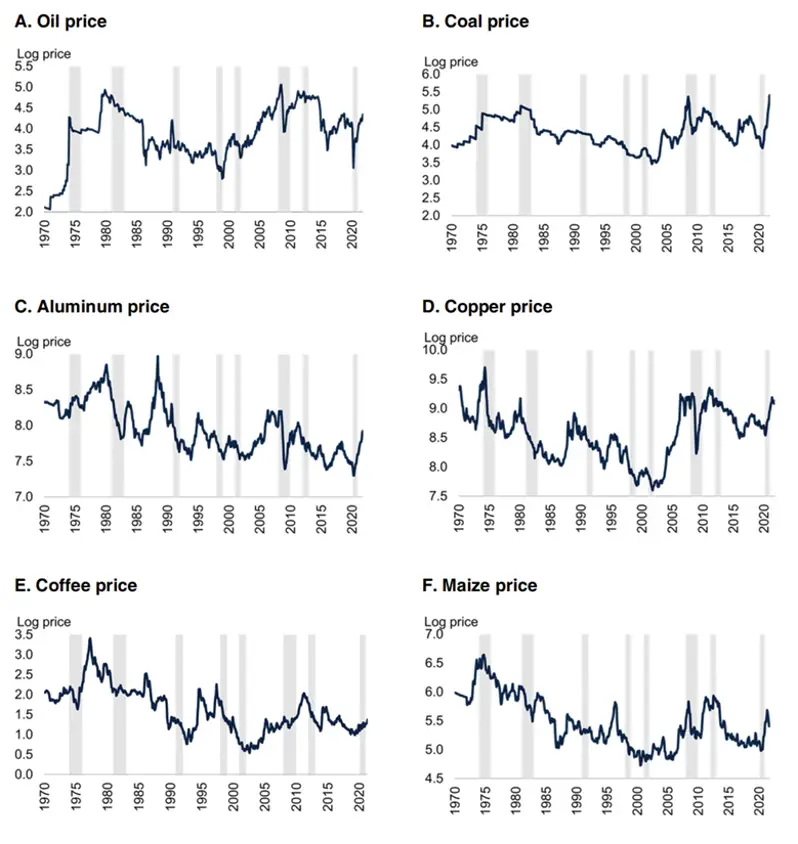

Hard commodities like oil, aluminum, copper, and coal depend on global market activity. When a recession hits one or more of the world’s largest economies, that effect spreads across all other economies. As a consequence, commodities supply and demand change because countries start to produce fewer goods and companies decrease their investment efforts to develop new products. The situation with soft commodities like maize, coffee, or wheat is different since their demand tends to be more inelastic. In the end, people will keep demanding them no matter what the economic situation.

Source: Federal Reserve Economic Data (St Louis Fed); World Bank.