CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

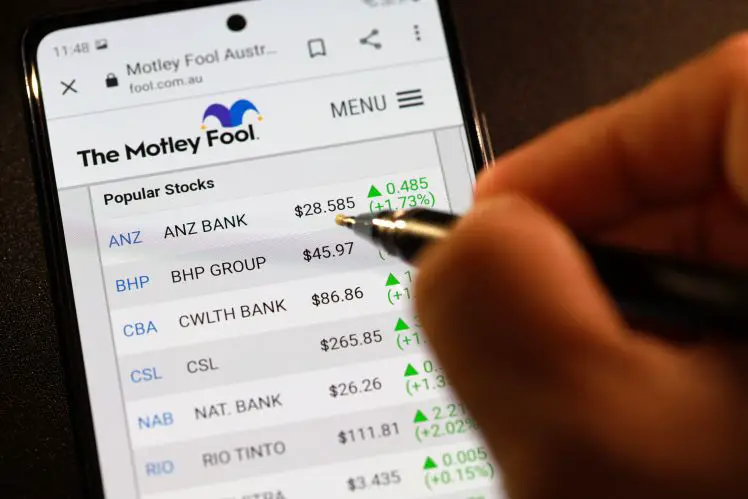

It’s time to take a look at Motley Fool, an investment company that offers its investors a chance to make money by investing in the stock market. It’s important that you understand that they want to help you earn a Long-Term Return and that you should plan on holding their stock for at least 5 years. If this suits your preference, take a look at this review before signing up.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

What is Motley Fool?

Founded in 1998, Motley Fool is an investment company that operates online. The Motley Fool is a website that offers stock recommendations to its members. The Motley Fool uses a team of professionals who publish their opinions on a variety of topics. They are known for publishing articles and blog posts on finance, investing, business, and more.

Stock Advisor’s premium stock-picking platform is the flagship of The Motley Fool. Stock Advisor gives its subscribers two great stocks to consider each month, plus a wealth of investing tools and tips. They also provide Best Buys Now and Starter Stocks, as well as live discussions and other features.

Motley Fool’s Stock Pick

Motley Fool stock picks have outperformed the market 4 times since they were launched in 2002. That’s a very big gain! Most of their stock picks are profitable, with roughly 60–70 percent of them making money. Some of the big winners of the last five years are up 11,000 percent to 16,000 percent, beating the market by a humongous margin.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Even though a lot of their picks won’t beat the S&P 500, their grand winners are still generating huge profits that means that their entire portfolio is competing in the market. Finding stocks that are sure to provide big profits is a big part of the Motley Fool’s secret ingredient. They have almost 200 stock picks that have delivered 100 percent profits or more. The average return from the Stock Advisor service is over 100 percent. More than 10 percent of their picks have gained 500 percent or more.

Stock Advisor invests in stocks with big upside potential. That means you cannot expect to receive big dividends from many of their picks. But when you look at a group of Stock Advisor picks, they tend to perform really well over time. Because the Motley Fool wants to invest in stocks that will pay a great dividend for a very long time, so it’s very important to have a portfolio that includes at least 25 stocks, which should be held for at least 5 years, in order to get some big winners and get good returns.

Your short-term performance will be unpredictable if you only buy a few Stock Advisor picks. But if you buy a diversified portfolio of 25+ stocks, you will have very good long-term performance.

Benefits of Motley Fool

They recommend high-quality stocks that will grow and have big growth potential over the long term, and blue chip stocks that will be profitable. They also send out two stock picks every month to their subscribers. That’s why many people sign up for their services.

They have a very complete archive of all the stocks that they have recommended, including those that are still open and those that are closed. Not only that, they offer curated lists of the best stocks to buy now and to invest in to help new investors get started investing in stocks.

They have a long history of picking stocks that have done extremely well and beating the market. Then, they closely monitor the markets for big changes in stock prices, and they share important information with members.

There are lots of resources designed to help investors who are just starting out learn how to invest and become more successful. Stock research and investing education are offered in plain English, not complicated financial markets speak.

Motley Fool is easy to use and their website is very modern and easy to navigate. Members can get timely updates by email or text message. They have excellent customer service by email and phone.

Motley Fool subscribers can get their money back if they are not satisfied with their stock recommendations within the first 30 days of their subscription. Their annual subscription is very reasonable compared to other service providers.

Motley Fool Drawbacks

Motley Fool members get a lot of marketing emails, which can be overwhelming.

Their focus is mainly on stocks that have a big upside potential. That means they don’t cover defensive or value stocks or dividend stocks. Because they invest in growth stocks, they don’t pay much attention to stock market valuations, and they recommend stocks with very high valuations.

They don’t do any technical analysis before recommending stocks, which may mean that some positions can be not ideal even though the company is a good long-term investment.

Stocks they recommend are often trading near all-time highs, which can seem risky to some members. They don’t offer any fair value targets or Buy Up To price cutoffs for the stocks that they recommend.

They don’t try to profit from big winners; they just let them run. They don’t have a bear-market strategy, and simply hold onto stocks when markets are down and continue to recommend new stocks.

Who is Motley Fool Best for?

If you’re looking to buy growth and blue chip stocks that are highly likely to be profitable in the next 3–5 years, and if you want to learn how to invest wisely, then joining the Motley Fool is the perfect opportunity for you. If you aren’t interested in investing in growth stocks, or if you don’t have enough time to learn how to invest and manage your own stocks, the Motley Fool isn’t for you. If you’re not sure, try our risk-free trial with the Motley Fool for 30 days. If you aren’t convinced, just request your money back.

Motley Fool offers investors a way to invest in the stock market and make money by following their opinions. This is a great service if you’re looking for an investment with the potential to make you money over time. Motley Fool is a great option for investors who want to follow expert advice on which stocks to buy. Keep in mind the drawbacks when using their services.