CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

The bad credit syndrome has spread to all segments of the population, including those with a good credit history. If you have bad credit, the chances are that you have run into some financial difficulties, and the fact that you have a good credit history is no longer enough to enable you to obtain a loan.

You need an effective strategy that will help you manage your money so that it does not become too stressful for you. In order to get a loan, you need to build your credit history and use this as collateral for obtaining loans.

However, there are still people who do not want to go through the hassle of dealing with their bad credit history, especially if they do not know how they can improve it. There are many financial services that offer bad credit loans but they are not always reliable.

A lot of people will ask why they should trust a financial advisor when there are so many who claim to be experts in this field but do not actually help with their financial problems. In this article, we will try to provide you with answers on how to get advice on how to improve your bad credit and access cheap loans online if this is what you want.

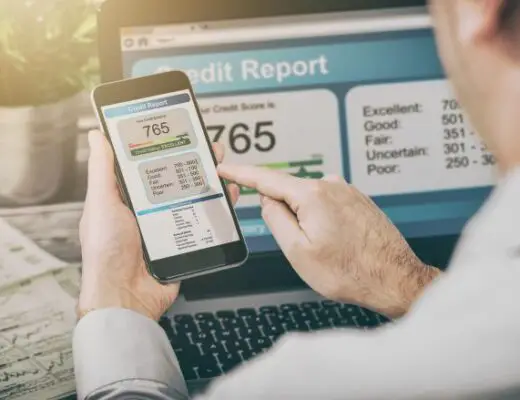

What Is Credit Score?

Your Bad Credit or Good Credit Rating is the score that financial institutions use to determine the creditworthiness of a borrower. It is a number calculated by the credit bureaus and is not related to your credit history.

It is a good indicator of your financial reliability and the probability that you will be able to pay back the loan. This score ranges from 300 to 850, and it has a direct impact on your chances of getting approved for a loan or for obtaining loans for some other purpose.

However, this score is not everything because there are other factors that influence it. These factors include: Your credit history – how many times you have borrowed money from banks or creditors in the past; Your ability to repay debts – how long it takes you to pay back loans; Your financial habits – if you tend to make payments on time, even if you are late at times; Your personal information – whether your name and address are correctly registered with all credit bureaus;

The amount of outstanding debt that has been assigned to you by lenders – this means how much debt they think you will be able to pay back without defaulting on your payments; How well you manage your money.

How to Improve Your Credit Score?

If you want to improve your bad credit, you need to make a list of things that will help you build your credit history. These include:

Using credit cards for small purchases; Applying for credit cards for larger purchases; Getting a car loan or financing through car dealerships; Getting an auto loan with less than perfect credit; Using loans from family and friends; Refinancing loans with better terms.

For those who have been using bad credit loans online, they will find that there are different methods of improving their bad credit score. For example, if you want to improve your score, it is best to use only secured loans.

However, if you are still not sure how to get good advice on how to improve your bad credit and get cheap loans online if this is what you want, it would be best if you consult with a financial advisor.