CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

Financial advisory is something that you have to have. With the help of this tool, you can keep track of your investments and you can also see what is happening with your portfolio.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

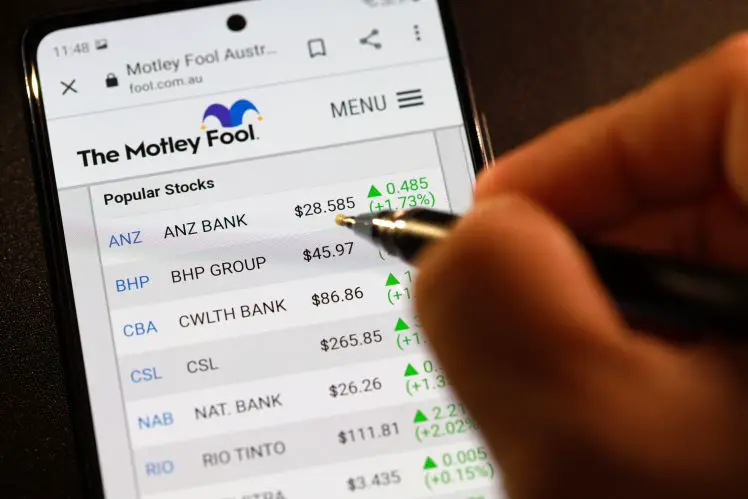

If you are not aware of the fact that the Motley Fool has its mutual fund, then let me tell you it is a good thing to know about. If you want to learn more about this, then continue reading this article.

What is Motley Fool?

This is a website that provides the latest information about stocks and mutual funds. It also provides articles you can read to learn more about investing. There are different portfolios that you can create.

Some unique features make this site stand out from the rest. For example, the site has some useful tools that help you manage your portfolio. It also has an online message board where you can ask questions about investing.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

The message board is very active and there are a lot of members who discuss different issues regarding investing and stock trading. This is a great way to learn how to make money from stocks.

Motley Fool Features Explained

When you create a portfolio, there are different portfolios that you can choose from. For example, you can create a portfolio with low-cost index funds or with actively managed funds. You can also combine the two and make your portfolio more balanced.

There are also different articles about different topics, such as stock market updates and news about investing. Some tools help you manage your investments and financial planning tools, such as budget planners, personal finance calculators, and retirement calculators.

What is a Mutual Fund?

A mutual fund is a kind of investment that has several investors. These investors put money into the fund to make a profit. This is a way to diversify your investments.

To get more information about this, you can go to the website of Motley Fool and you see that there are many types of mutual funds. For example, they focus some on the stock market index and some on different stocks.

You can also find different funds, such as large-cap funds, mid-cap funds, small-cap funds, international funds, bond funds, and commodity ETFs. There are also specialty investment funds, such as energy sector ETFs and municipal bond ETFs.

Does a Motley Fool Have A Mutual Fund?

The Motley Fool has its mutual fund called the FOOLX fund. This is a mutual fund that is very low-cost. It has a total expense ratio of 1.09%. This means that you will only pay 1.09% in fees every year when you have your investments in this fund.

If you want to learn more about this, then check out the Fool.com website and you will see that there are different articles about this fund and how it has low costs compared to other mutual funds.