CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

Financial advisory firms have made an enormous impact on the personal finance industry. The U.S. economy is a great example of this.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Financial advisory firms are a booming business for two reasons: (1) The need for advice and (2) the fact that there are so many types of people who require it. While everyone’s needs are different, there are some common themes that every client has in their lives.

Is Financial Advisory Service Legit?

Financial advisory firms can be extremely beneficial to both individual and corporate clients. These firms can provide the most comprehensive investment services, asset allocation advice, and other personalized financial management services.

If you are considering working with a financial advisory firm, you need to know that they are legitimate.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Does the firm have a track record of helping clients in similar situations? This can be an important part of finding a good fit for your situation. The best way to find out is by asking around and looking at the firm’s past clients.

Find out how many people they have helped, how long they have been working with them, and what results they have had for them. It’s also important to ask about their fees.

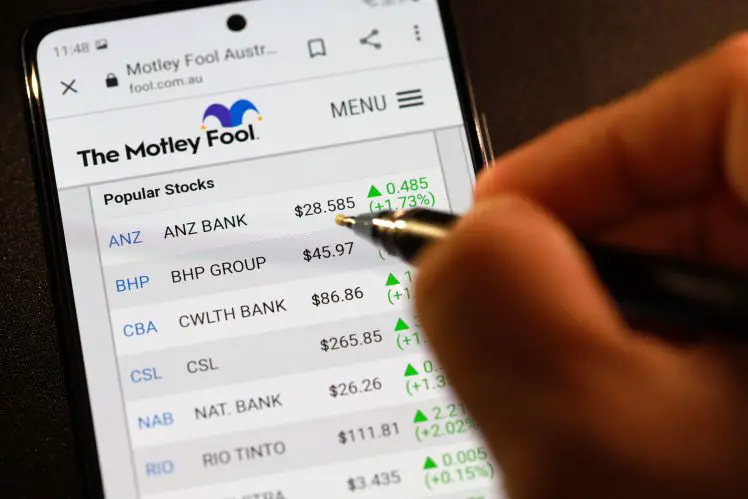

What is Motley Fool?

Motley Fool is a great place to go for help in the financial advisory industry. The firm is a great fit for investors of all kinds. The firm is dedicated to helping people with all of their financial needs, including investing and retirement planning.

The Motley Fool has been providing services to investors since 2001. This company has an excellent reputation in the financial advisory industry and has helped many clients achieve better results in their investment portfolios.

Clients can be confident that they are working with a reputable firm when they work with Motley Fool, as the company has been consistently ranked as one of the best firms.

How Does Motley Fool Work?

Motley Fool offers many services that are tailored to each client’s individual needs and preferences. The firm will work with you to identify your goals and then customize a plan that fits your needs and budget.

Clients can be confident that they are working with a professional team who will help them make smart investment decisions on their behalf.

With a team of experts, clients can get help in just about any area related to personal finance, including retirement planning, investing, tax advice, budgeting, and insurance advice, among others.

Does Motley Fool Have A Portfolio Tracker?

The Motley Fool has a great selection of services that help investors achieve their financial goals. Clients can work with the firm to build a portfolio of investment options and other services that will help them achieve their goals.

One of these is the portfolio tracker.

It is a great service for investors who want to keep track of their portfolios and how they are performing. This tool will provide real-time data about your portfolio performance so you can monitor your progress toward your goals.

With this tool, you can see your portfolio’s current performance, as well as previous performance over time, so you can see how your investments have been performing over time and how they have performed compared to other investment options available in the market today.