CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

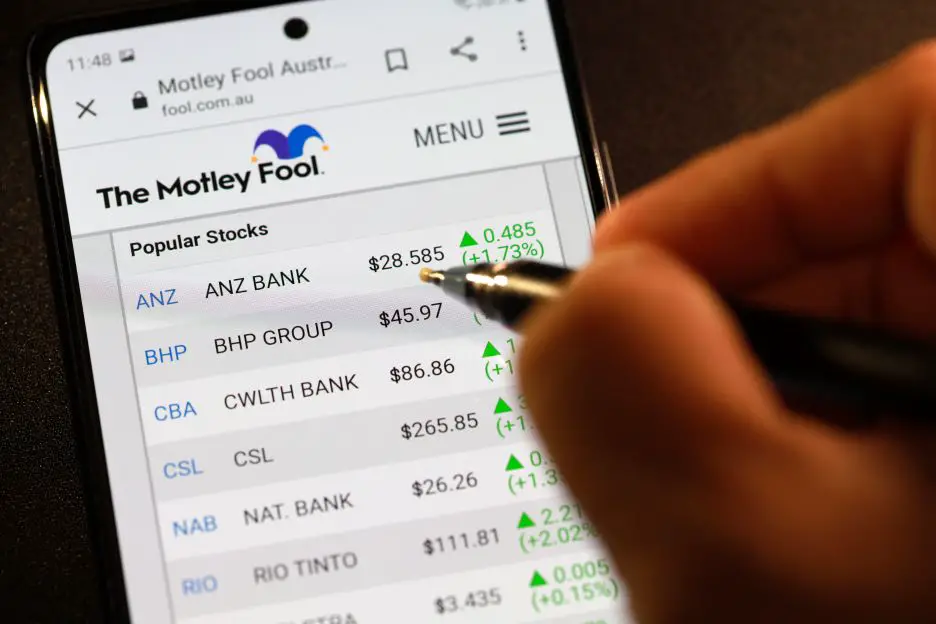

Motley Fool is a financial website that was founded in 1993 by Tom Gardner and David Gardner. The website provides investors with financial advice and news, as well as stock ratings and analysis. This information can help investors make informed decisions about their investments. The website’s goal is to help its readers achieve their financial goals.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

The stock market is a collection of markets that collectively provide a snapshot of the economy. The markets are divided into two types: primary and secondary. The primary markets are where companies sell their stocks to the public. The secondary markets are where investors buy and sell stocks.

The stock market is a complex system that can be difficult to understand. That’s why it’s important to have a strategy for investing in the market. A good strategy will help you make informed decisions about which stocks to buy and sell.

One way to make money in the stock market is to invest in stocks that are expected to outperform the market. This is called “stock picking.” Stock picking is a skill that can be learned, but it takes time and experience to be successful.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Another way to make money in the stock market is to invest in stocks that are expected to decline in value. This is called “stock trading.” Stock trading is a risky proposition, and it’s important to be aware of the risks involved.

The stock market is a volatile and unpredictable system. A good strategy will help you make informed decisions about which stocks to buy and sell.

Financial advisors can help you create a strategy for investing in the stock market. Motley Fool, a website owned by The Motley Fool, provides helpful information about investing in the stock market. So, if you’re interested in learning more about the stock market, you can check out Motley Fool’s website.

Does Motley Fool Outperform The Market?

Motley Fool Stock Advisor is a popular stock recommendation and investing education service that recommends growth stocks and blue chips. It has a strong history of beating the market since it launched.

Motley Fool investors have made 144 stock picks since 2016 that have returned an average of 171% (that is better than the SP500 return of 92%).

Motley Fool beats the SP500 by an average of 93% across 144 stocks! That is an impressive fact.

That’s 93% versus the market average of 92%! That is more impressive than it sounds. The Motley Fool has crushed the market by beating the SP500 by an average of 93% in 6 years.

However, it’s important to note that not all investments will beat the market. Some investments, such as cash and short-term government bonds, may have negative returns. So, it’s important to do your own research before investing in any stocks or securities. The Motley Fool is a great resource for learning about the stock market, but it’s important to remember that there is no guarantee of success, and you should never invest money that you cannot afford to lose.