CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

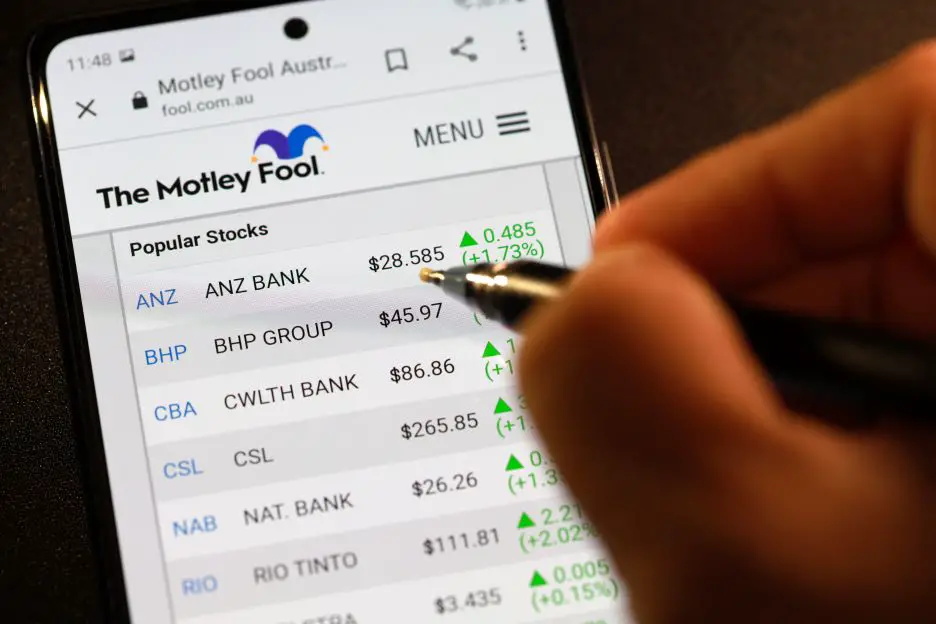

Motley Fool is a private financial and investing advice company based in Alexandria, Virginia. It was founded by co-chairmen and brothers David Gardner and Tom Gardner, and is led by its former chief executive, Erik Rydholm, who has since left the company. The Motley Fool has provided trusted advice to millions of individuals over the last 20 years.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Morningstar, Inc., is a leading investment research and advisory firm based in Chicago, Illinois. It was founded by Joe Mansueto in 1984. Morningstar is a leading provider of financial services, such as investment research and investment management.

Both companies offer a wealth of information and advice to their respective members. The Motley Fool provides investment advice and financial analysis, while Morningstar provides investment research and ratings for over 3,000 stocks, mutual funds, ETFs, and other securities.

The Motley Fool has a strong focus on providing financial advice to people of all ages and experience levels. It offers a variety of services, including individual and family investment planning, retirement planning, and more. Morningstar also offers a wide range of services, including stock analysis, mutual fund ratings, and retirement planning.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Why Financial Advice Matters

Financial advice is an important part of any individual’s financial life. It can help you make informed decisions about your investments, your debts, and your overall financial security. Financial advice can also help you live a more financially secure life by helping you to identify and address potential financial risks.

The Motley Fool offers a variety of financial advice products and services, including individual and family financial planning, retirement planning, and investment advice. Morningstar offers a variety of investment research products and services, including mutual fund ratings, stock analysis, and portfolio management.

The Motley Fool and Morningstar offer different types of financial advice, but they both offer important financial advice that can help you live a more secure and financially secure life.

Is Motley Fool Or Morningstar Better?

Morningstar offers extensive and sophisticated analysis which is geared towards helping investors make better decisions. It is not designed to make investment decisions for you. It will not tell you which stocks to buy. It will only show you which stocks, mutual funds, and other investment strategies are performing well according to its mostly quantitative analysis.

Motley Fool focuses on picking stocks based on its proprietary research, while Morningstar provides a much broader range of analysis to help investors decide which stocks to buy. So it is difficult to compare how different firms have performed in the past versus how different analysts have performed over the years.

Motley Fool’s Stock Advisor and Morningstar’s Investor are two highly regarded companies that provide competitive research in the investment industry.

Motley Fool is better for investors who have a diversified portfolio but who want to buy individual stocks to try to outperform the market by buying a small portion of their investments.

Morningstar is better for those who want to own a portfolio that includes stocks, mutual funds, and ETFs.