CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

Who doesn’t love to make money? For many people, making money through stock, trade, and the stock market is one of the most exciting things they can do. But with all the information out there, it can be hard to know what to do and where to start.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Finance is a complex topic, and there are many different types of financial advisors out there. A financial advisor is a professional who helps people manage their money. They can provide advice on investments, insurance, and other financial matters. They can also help you plan for your future and make sure you’re taking the right steps to protect your money.

A financial advisor can help you with a variety of financial matters, including investments, insurance, and retirement planning. They can also help you plan for your future and make sure you’re taking the right steps to protect your money.

An investment, for example, is a decision you make about how to use your money. You might invest in stocks, bonds, or other types of investments. This can give you the opportunity to make money if the stock market goes up, and it can protect you if the stock market goes down.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

An insurance policy can help you protect yourself from a possible financial loss. For example, you might have insurance that covers your home, car, or life insurance.

A retirement plan can help you save for your future. You might choose to save money in a 401(k) plan, a traditional retirement plan, or a Roth IRA.

A financial advisor can help you with all of these things and more. They can also help you figure out which financial products are best for you and help you to understand the risks involved in each option.

A financial advisor can charge a variety of different fees. Some of the most common fees are a commission fee, an investment advisory fee, and an insurance policy fee.

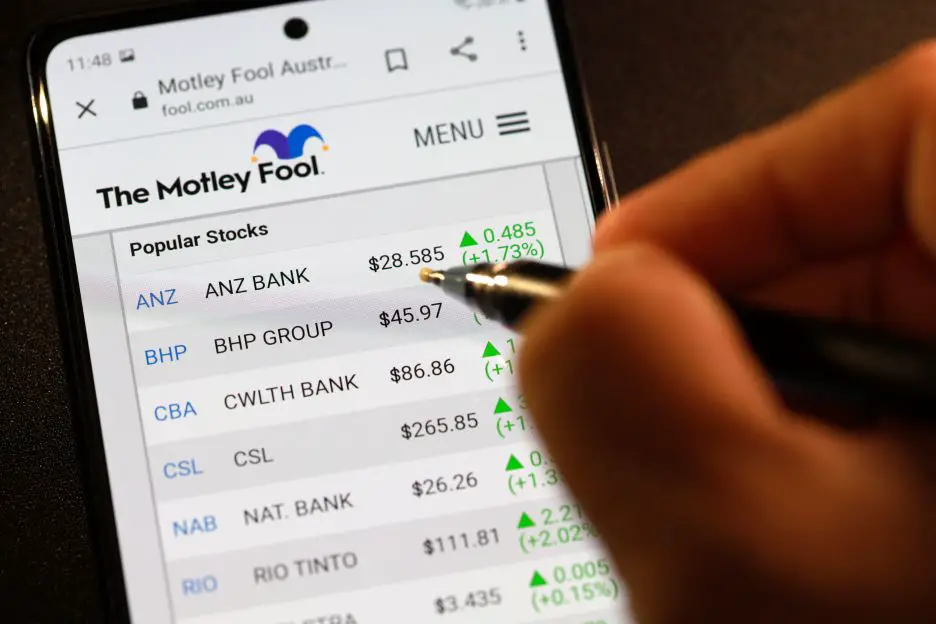

The Motley Fool was founded in 1993 by brothers Tom and David Gardner as a traditional print newsletter in a backyard shed in Alexandria, Virginia. In 1994, a joke that was created by someone as an April Fool’s Day joke and was meant to teach people how to invest wisely, put The Motley Fool on the map. Tom and David Gardner, along with their loyal community of Fools friends, have been leading the charge for individual investors since 1993.

Is Motley Fool Publicly Traded?

Generally, shares of a company that is listed on the stock exchange are available for anyone to buy. They can also be sold very easily. Note that publicly traded companies are not owned by any government; the company is not in control by any government. Public ownership of companies is rare in the U.S., but it is common in other countries.

Motley Fool is a private company. This means that the company does not issue shares that are publicly traded and the shares are not available for purchase on the open market. Instead, Motley Fool shareholders own the company through a special type of ownership called “ownership of common stock.” Ownership of common stock gives shareholders the right to vote on matters such as corporate strategy and financial matters.