CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

One of the most important things you can do for your financial future is to invest. However, it can be difficult to know where to start. There are a number of different ways to invest, and it is important to choose the one that is right for you. Some people prefer to invest in stocks, while others prefer bonds. Each has its own benefits and drawbacks.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Stocks are a type of investment that involve ownership of a company or corporation. They are often considered to be the most risky, but also the most profitable. The potential for growth is what makes stocks so exciting, and there is always the chance that they will go up in value. However, stocks can also be volatile, and they are subject to a lot of risk.

Bonds are another type of investment. They are a type of loan that is issued by the government or a company. The borrower pays back the bond with interest, and the bond is usually a fixed amount of time. This means that it is not as risky as stocks, since the value of the bond will not change over time. Bonds are usually a good choice for people who are conservative with their money, since they are not as volatile.

It is important to do your research when it comes to investing, and an advisor can help you choose the right type of investment for you.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Why Seek Financial and Investing Advice?

There are a number of reasons why you might want to seek financial and investing advice. Perhaps you are not sure where to start, or you are not sure what the best option is for you. An advisor can help you choose the right type of investment, and they can also help you to understand the risks involved. They can also help you to stay on top of your finances, and to make sure that you are making the best decisions for your future.

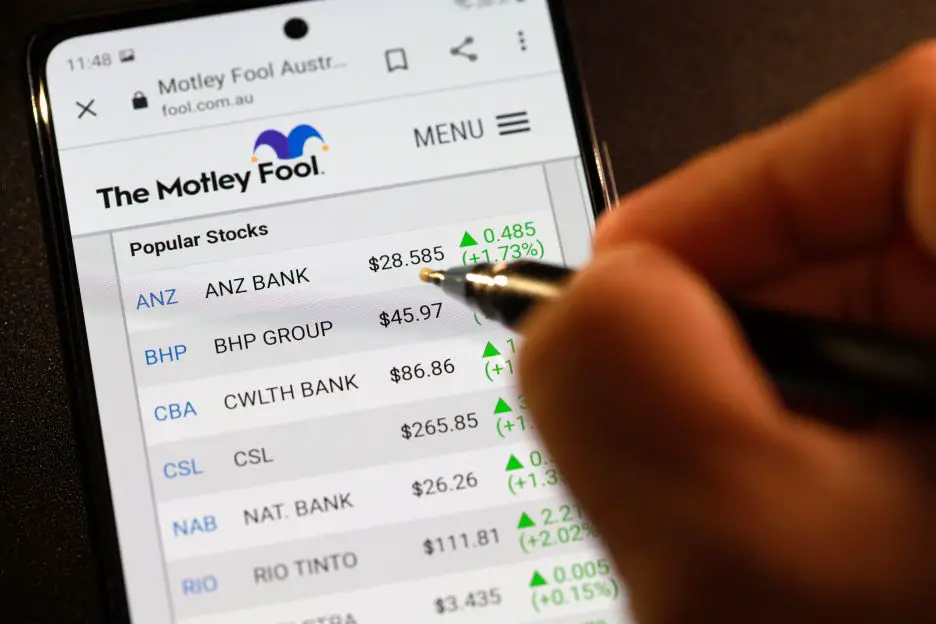

The Motley Fool

The Motley Fool is a website that gives financial advice. It was founded by two brothers in 1993. They help people become financially free by offering free advice and information on their website, podcasts, books, radio shows, and investing services. They believe that investing can help people become financially free. They believe that investing in a good company can help people become financially secure.

Is Motley Fool Trustworthy?

The Motley Fool offers a variety of services, including financial advice, investing advice, and education. They have a good reputation for being trustworthy. They have been in business for over 20 years, and they have a large user base.

The Motley Fool has a paid subscription service, which offers more information and access to their experts. They also offer a free trial, which allows you to try their services before you decide to subscribe.

The question whether The Motley Fool is trustworthy is subjective. Some people may feel that they are not as honest as other financial advisors, while others may feel that they are honest and reliable. Overall, The Motley Fool has a good reputation for being trustworthy, so it is a good option for those looking for financial advice.