CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

Financial and investing advice can be extremely helpful for people looking to improve their financial situation. However, not all financial advisors are qualified or trustworthy. Before you invest your money, it is important to do your research and find a reputable advisor.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Before you talk to a financial advisor, it is important to do your research. You should look for a financial advisor who is qualified and trustworthy. Qualified advisors have passed a rigorous exam or have been in the business for a certain amount of time. Trustworthy advisors will have a good reputation and will be able to answer any questions you have about finances.

There are several types of investments available, and each has its own set of risks and benefits. Before you invest money, it is important to understand the risks and benefits of each option. Additionally, different investment options may have different tax implications. It is important to consult with an accountant if you are unsure about which investment option is best for you.

Another important factor to consider when investing is your risk tolerance. Some investments are more risky than others, and it is important to understand the risks before making an investment decision. Some investments, such as stocks, can be volatile and may experience significant fluctuations in value over short periods of time. If you are not comfortable with the risk of an investment, you may want to consider choosing an alternative investment option.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

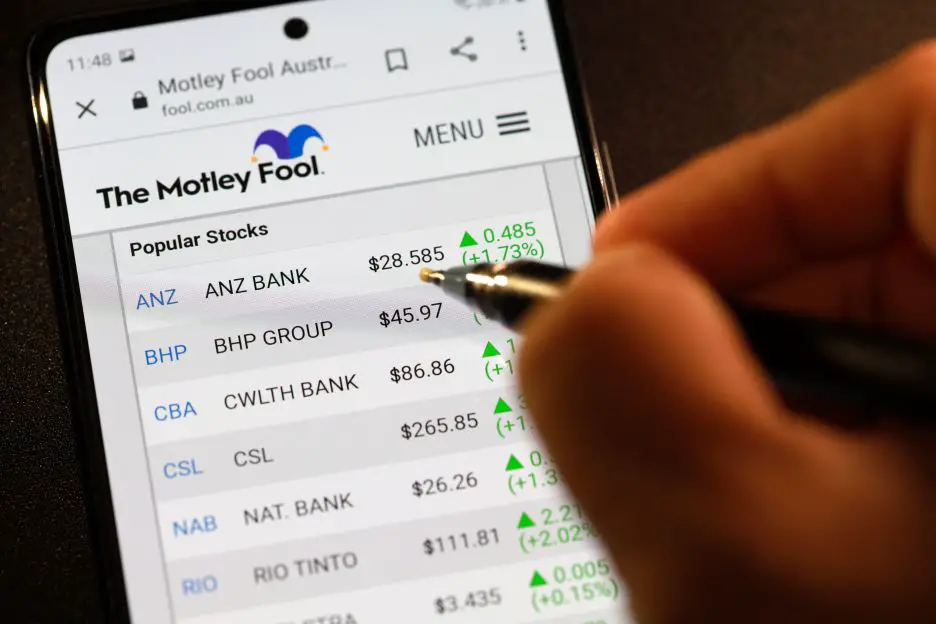

Motley Fool is a financial advice website founded by two brothers in 1993. They help people become financially free by providing financial advice and public speaking services. They help people become financially free by providing a website, podcasts, books, radio shows, and investing in premium services. They believe that investing can help people become financially secure. They believe that investing in the right way can help people become financially secure.

Motley Fool’s Triple Down Stock

In the internet-based stock market, subscription services are becoming increasingly popular. Netflix, Hulu, and Amazon Prime are all subscription services that allow users to watch television shows and movies on a regular basis.

People are increasingly turning to subscription services because they believe that they provide a better experience than going to the movies or television shows individually in this digital age. This is especially true for television shows, as many people are now binge-watching entire seasons of television shows in a single sitting.

Shopify, PayPal, and other e-commerce platforms are also becoming increasingly popular. Shopify is a platform that allows people to create their own online stores. PayPal is a payment platform that allows people to make payments online.

Triple Down Stock is a new stock trading strategy that uses three different stocks to create a diversified portfolio. The strategy is based on the idea that when the prices of three different stocks are moving in opposite directions, the overall market is likely to be moving in the same direction.

The basic idea behind Triple Down Stock is to use three different stocks to create a diversified portfolio. When the prices of these stocks are moving in opposite directions, this signals that the overall market is likely to be moving in the same direction.