CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

Financial advisory services are a fairly standard offering in the financial services industry.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Many recommend an average investor invest his money with a financial advisor. For most of us, that means hiring a broker or adviser who will help us decide how much money to invest, how to invest it, and how often we should be investing.

In most cases, we don’t know what’s going on in the background. Our broker or adviser doesn’t tell us he’s getting paid from the investment companies he’s pitching to us.

Most times, the financial advisory services we get are pretty expensive too. It costs a lot of money to hire someone who will sit with you for an hour or two each month and give you advice about your investments.

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

You have to pay the broker/adviser some sort of fee for his time, even if he never talks about any specific investments with you.

And because of that fee, there is some risk that your broker/adviser will be motivated to make decisions that lead you down a path where you end up losing money in the long run, anyway.

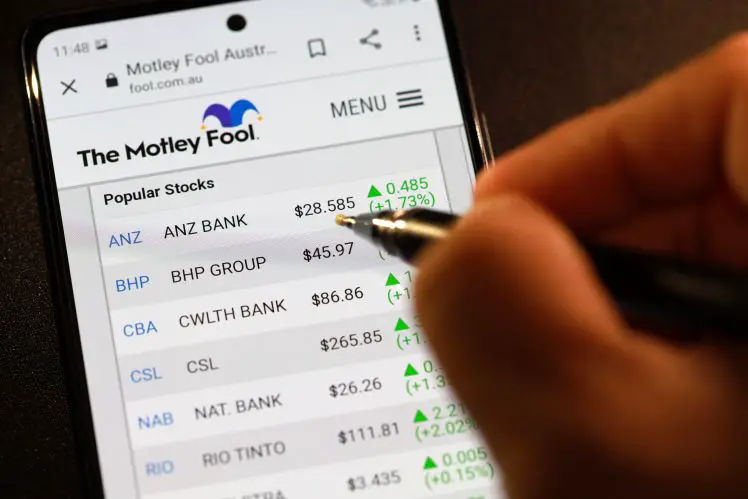

What is Motley Fool?

Motley Fool is a company that sells a variety of financial services. They’re based in the United States and they sell services like mutual funds, stocks, bonds, investment advice, and other services. The Motley Fool is one of the oldest and most well-known brands in the industry.

In recent years, Motley Fool has offered an array of different financial advisory services that are often sold as part of their investment advisory packages. One example is their online stock market service called Stock Advisor.

This service provides investors with recommendations on what to buy and sell for their portfolios.

Motley Fool Features Explained

Motley Fool offers several features. For this review, we’ll look at some of the most popular features that they offer and why they’re important to investors.

Stock Advisor

This is a service that lets investors access the Motley Fool’s stock market recommendations and portfolio analysis. The service is available on the web and it’s available through a variety of different platforms, including mobile devices.

Everlasting Stocks

This is a service that helps investors decide what to buy and sell in their portfolios. Investors can set up the service to send out recommendations regularly, such as every quarter or every month.

This is an extremely useful service for investors who are interested in getting regular advice on how to invest their money.

Rule Your Retirement

This is a service that helps investors manage their retirement funds. Investors can use the service to decide about how much money they should invest when they should invest it, and where they should invest it.

Investors can also set up alerts that notify them when the service identifies that they’re not on track with their retirement plans.

Is Motley Fool A Ripoff?

The Motley Fool is one of the oldest and most well-known brands in the financial advisory industry. The company has offered a variety of different financial advisory services for many years and it’s no surprise that they have built up a solid reputation.

They’re certainly not a ripoff, but they do charge fees for their services.

This service would be best suited for investors who are already making excellent investments on their own or who have a specific set of investments that they want to follow.