CommonCentsMom.com is advertiser-supported: we may earn compensation from the products and offers mentioned in this article. However, any expressed opinions are our own and aren't influenced by compensation. The contents of the CommonCentsMom.com website, such as text, graphics, images, and other material contained on this site (“Content”) are for informational purposes only. The Content is not intended to be a substitute for professional financial or legal advice. Always seek the advice of your Financial Advisor, CPA and Lawyer with any questions you may have regarding your situation. Never disregard professional advice or delay in seeking it because of something you have read on this website!

Financial planning is the process of developing a plan to manage one’s financial resources in order to achieve specific financial goals. Financial planners typically work with individuals and families to help them identify and address their individual financial needs, objectives, and risks.

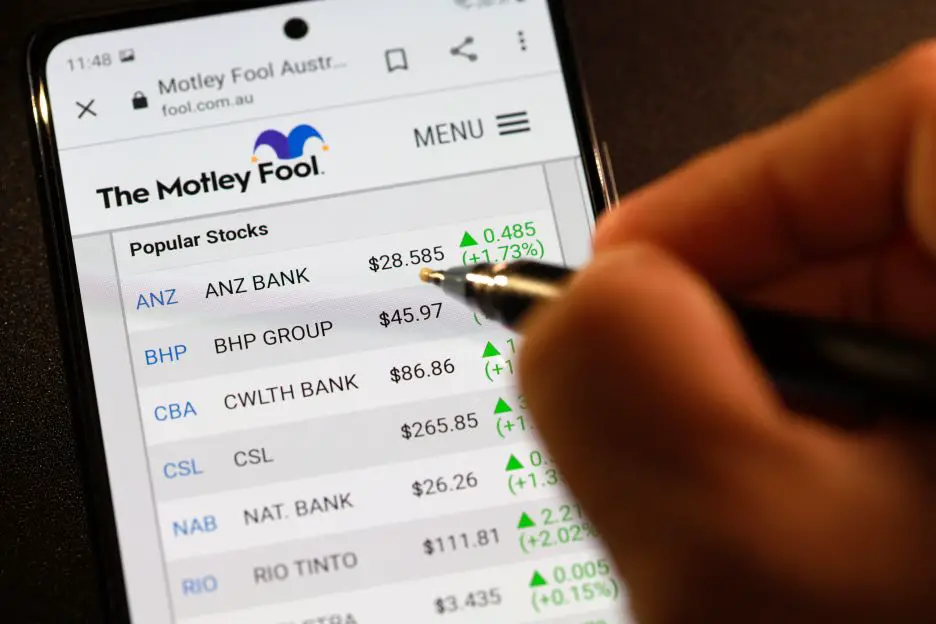

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

Financial planning can help individuals save for their future, plan for retirement, and protect their assets from risk. Financial planners also may provide advice on investment options, estate planning, and other financial matters.

The goal of financial planning is to help individuals achieve their long-term financial goals while minimizing risk and maximizing potential benefits. Financial planners typically use a variety of tools and techniques to help clients reach their goals, including individualized analysis, advice on budgeting and spending, risk assessment, and investment recommendations.

Retirement And Financial Planning

Retirement planning is an important part of financial planning. Retirement planning helps individuals plan for their future and ensure that they have enough money to live comfortably after they retire. retirement planning typically includes the following steps:

Stock Advisor Picks Returned >500%. If you give Stock Advisor a try and decide it’s not for you, simply cancel within 30 days and you’ll receive every penny of your membership fee back.

- Developing a retirement plan: Individuals need to develop a retirement plan if they want to have a secure retirement. A retirement plan is a document that outlines how an individual plans to fund his or her retirement.

- Calculating your required savings: You need to calculate how much money you will need to save each month in order to have enough money available when you retire. This calculation depends on your age, income level, and other factors.

- Determining your withdrawal rate: You also need to determine your withdrawal rate—the percentage of your income that you will use each month to live comfortably during retirement. This rate will change as you age and may need to be adjusted over time in order to maintain your desired level of living.

- Allocating your savings: Once you have determined your required savings and withdrawal rate, you need to allocate that money to the appropriate accounts. This includes developing a retirement plan and saving for your retirement in a tax-advantaged account, such as a 401(k) or IRA.

Planning your retirement is an important part of financial planning. Financial planners can help you develop a retirement plan and calculate your required savings. Financial planners can also help you determine your withdrawal rate and allocate your savings to the appropriate accounts.

If you don’t have a retirement plan or if your retirement plan is not working well for you, you may need to seek the help of a financial planner, or some advice on retirement planning from a financial advisor.

Is the Motley Fool Rule Your Retirement Worth It?

It is worth it to plan for retirement. Rule Your Retirement is truly one of the best retirement planning tools available.

Rule Your Retirement members get access to a selection of customized portfolios and get rebalancing guidance, and also get recommended ETFs and mutual funds, as well as useful advice on other important financial topics. In addition, the newsletter keeps you informed about new articles that have been published.